In truth, gold has been money longer than any foreign money in history. Gold fulfills this promise higher than any foreign money. You'll be able to all the time sell it if you happen to want forex. CashforGoldUSA is our recommendation for the perfect place to sell gold bullion and gold bars, based on our standards for very high status, historical past of paying a fair worth, speed, and overall intent to treat prospects properly. It additionally has a status for retaining its worth well in periods of inflation. Likewise, the annualized return of gold over ten years has been way greater than that of inflation. However, some recommend that there is proof that when equities are under stress, in different phrases, when shares are falling rapidly in worth, an inverse correlation can develop between gold and equities. There are numerous gold bar packages with Gram-Kilo Gold bars, and a few fashionable designs embody Fortuna, Rosa, Lunar Gold, and Mint Logos.

In truth, gold has been money longer than any foreign money in history. Gold fulfills this promise higher than any foreign money. You'll be able to all the time sell it if you happen to want forex. CashforGoldUSA is our recommendation for the perfect place to sell gold bullion and gold bars, based on our standards for very high status, historical past of paying a fair worth, speed, and overall intent to treat prospects properly. It additionally has a status for retaining its worth well in periods of inflation. Likewise, the annualized return of gold over ten years has been way greater than that of inflation. However, some recommend that there is proof that when equities are under stress, in different phrases, when shares are falling rapidly in worth, an inverse correlation can develop between gold and equities. There are numerous gold bar packages with Gram-Kilo Gold bars, and a few fashionable designs embody Fortuna, Rosa, Lunar Gold, and Mint Logos.

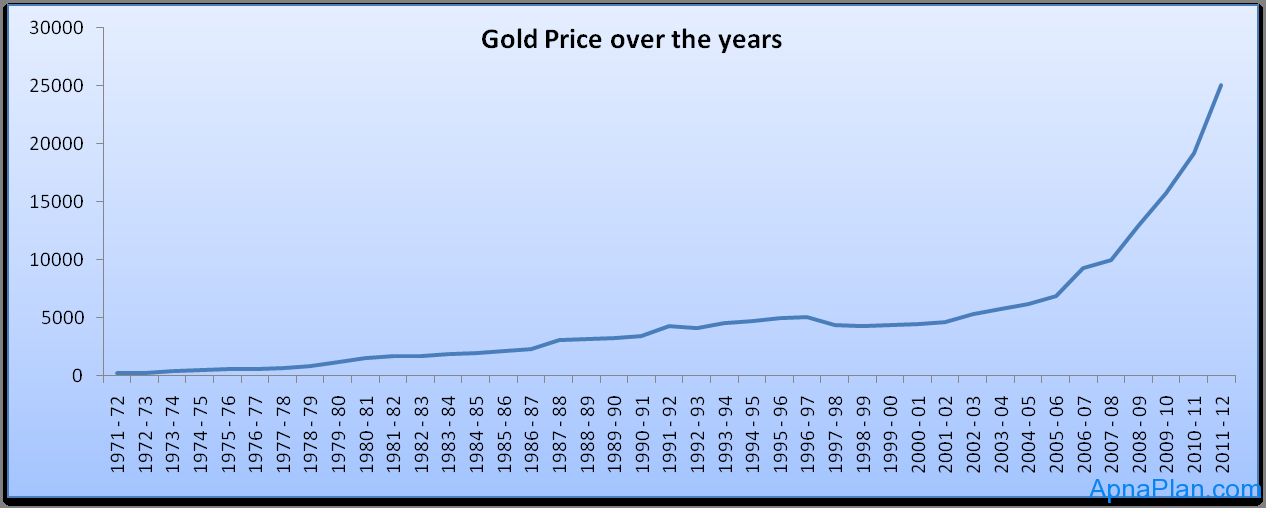

However, all forms of gold are equally engaging for investments. However, it does include its personal dangers. 2. Evaluate your danger tolerance: Understand how comfy you might be with taking dangers and consider elements equivalent to your age, financial stability, and willingness to withstand market fluctuations. Supply and demand, geopolitical events, and central financial institution coverage are all factors that may have an effect on these fluctuations and must be taken into consideration when making any investment choices related to gold. Incorporating gold and silver bars into your investment technique can diversify your portfolio and provide protection against market fluctuations. There have been durations whereby the brief-term currencies grew in worth greater than gold, however over the lengthy-time period, this chart demonstrates exactly why the rich have all the time held it in their funding portfolio. This requires significantly extra analysis than tracking the gold price, as a company’s success shall be linked to its exploration actions, enterprise technique and administration. Rather than shopping for precise gold, you could possibly consider backing the businesses involved in gold exploration or mining.

However, all forms of gold are equally engaging for investments. However, it does include its personal dangers. 2. Evaluate your danger tolerance: Understand how comfy you might be with taking dangers and consider elements equivalent to your age, financial stability, and willingness to withstand market fluctuations. Supply and demand, geopolitical events, and central financial institution coverage are all factors that may have an effect on these fluctuations and must be taken into consideration when making any investment choices related to gold. Incorporating gold and silver bars into your investment technique can diversify your portfolio and provide protection against market fluctuations. There have been durations whereby the brief-term currencies grew in worth greater than gold, however over the lengthy-time period, this chart demonstrates exactly why the rich have all the time held it in their funding portfolio. This requires significantly extra analysis than tracking the gold price, as a company’s success shall be linked to its exploration actions, enterprise technique and administration. Rather than shopping for precise gold, you could possibly consider backing the businesses involved in gold exploration or mining.

This might imply buying shares in gold miners. You won’t actually own any gold immediately - although provider HANetf provides a product which allows buyers to redeem their shares for physical bars and coins stored on the Royal Mint. Gold coins can have extra worth than bars as they may be rarer and are sometimes seen as collectables, often called numismatic coins. For extra info on gold prices, take a look at our gold price index. This liquidity means you can take gold with you actually wherever on the earth. How Much Is Gold Worth? Purchasing gold is much easier compared to buying other tangible belongings such as real estate. Unlike stocks, bonds, cryptocurrencies, actual estates, among a series of other investments, gold requires no specialised skills. Individuals can invest in gold in two major ways: physical gold (aka bullion) or gold securities (stocks, funds, and futures). Compulsions, on the other hand, are repetitive behaviors or psychological acts that people feel driven to carry out in response to their obsessions. Symptoms of OCD embody persistent anxiety and fear, difficulty tolerating uncertainty and doubt, and a cycle of obsessions and compulsions.

Understanding the causes and danger components of OCD is a vital step in the direction of breaking free from the disorder. Obsessive Compulsive Disorder (OCD) is an anxiety disorder characterized by unwanted thoughts and pictures, known as obsessions, that cause anxiety. Mises's e book Socialism had an unlimited affect during the 1920s and 1930s, not only in raising profound questions of socialists, but additionally in converting countless young socialist intellectuals to the reason for freedom and free markets. Free reward to enthusiast. Is gold a superb investment? It’s natural and even prudent for an investor to surprise if a particular asset is an effective funding or not. That’s especially true for gold, since it’s an inert metal and doesn’t earn any interest. In a rustic like India, the place every saving instrument might not present returns, gold fares properly when the inflation price exceeds the interest rate. Along with running up towards advocates of inflation, decrease curiosity charges, and lower trade rates, Mises was shocked to face ferocious opposition by the central bank, the Austro-Hungarian Bank. It's now typically acknowledged, particularly in Communist nations, that Mises and Hayek had been right, and that the enormous defects of socialist planning in observe have confirmed their views.